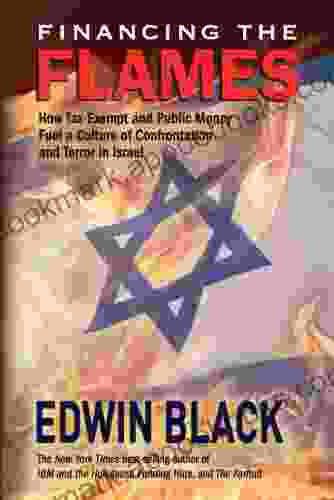

In the aftermath of countless incidents of violence and terrorism, a disturbing truth has emerged: tax-exempt and public funds are being weaponized to fuel a culture of confrontation and terror.

4.5 out of 5

| Language | : | English |

| File size | : | 6328 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 290 pages |

| Item Weight | : | 9.5 ounces |

| Dimensions | : | 5 x 1.03 x 7.76 inches |

Under the guise of philanthropy and public service, organizations and individuals have exploited tax exemptions to amass vast sums of money, which are then channeled into activities that incite hatred, division, and violence.

The Invisible Funding Network

The network of tax-exempt organizations involved in this illicit funding scheme is vast and complex. Non-profit organizations, religious groups, and educational institutions have all been implicated in providing financial support to extremist groups.

These organizations often operate under the guise of promoting charitable or educational missions. However, a closer examination reveals that their true purpose is to spread propaganda, recruit new members to extremist ideologies, and provide logistical support to terrorist organizations.

The Role of Public Funds

Equally alarming is the involvement of public funds in fueling the culture of confrontation. Government grants and subsidies have been directed to organizations that promote extremist agendas.

This misallocation of public resources not only undermines the integrity of government institutions but also legitimizes extremist views. It creates a dangerous feedback loop, where public funds are used to create a climate of fear and division that further fuels the demand for extremist solutions.

Consequences for Society

The consequences of this covert funding scheme are devastating. It has led to a dramatic increase in hate crimes, civil unrest, and acts of terrorism.

By providing financial support to extremist groups, tax-exempt and public funds empower individuals and organizations to sow discord, undermine trust, and threaten the stability of society.

Complicity and Accountability

The complicity of tax authorities and government agencies in this scheme is equally concerning. These entities have often failed to properly scrutinize tax-exempt organizations and prevent the misuse of public funds.

This lack of oversight has allowed extremist groups to flourish and spread their dangerous ideologies. Urgent action is needed to hold tax authorities and government agencies accountable for their role in this crisis.

Need for Reform

The time has come to address the urgent need for reform. We must:

- Strengthen oversight of tax-exempt organizations to ensure that they are not being exploited for extremist purposes.

- Revoke the tax-exempt status of organizations that engage in hate speech or incite violence.

- Establish clear guidelines on public funding to prevent it from being used to support extremist agendas.

- Hold government agencies accountable for their role in funding extremist groups.

By taking these steps, we can disrupt the funding network that fuels the culture of confrontation and terror. We can restore trust in our institutions and create a more just and peaceful society for all.

The exposure of the insidious role of tax-exempt and public funds in fueling a culture of confrontation and terror is a wake-up call for society. It is a reminder that even in the name of charity or public service, vigilance is essential.

By demanding transparency, accountability, and reform, we can create a society where peace and harmony prevail.