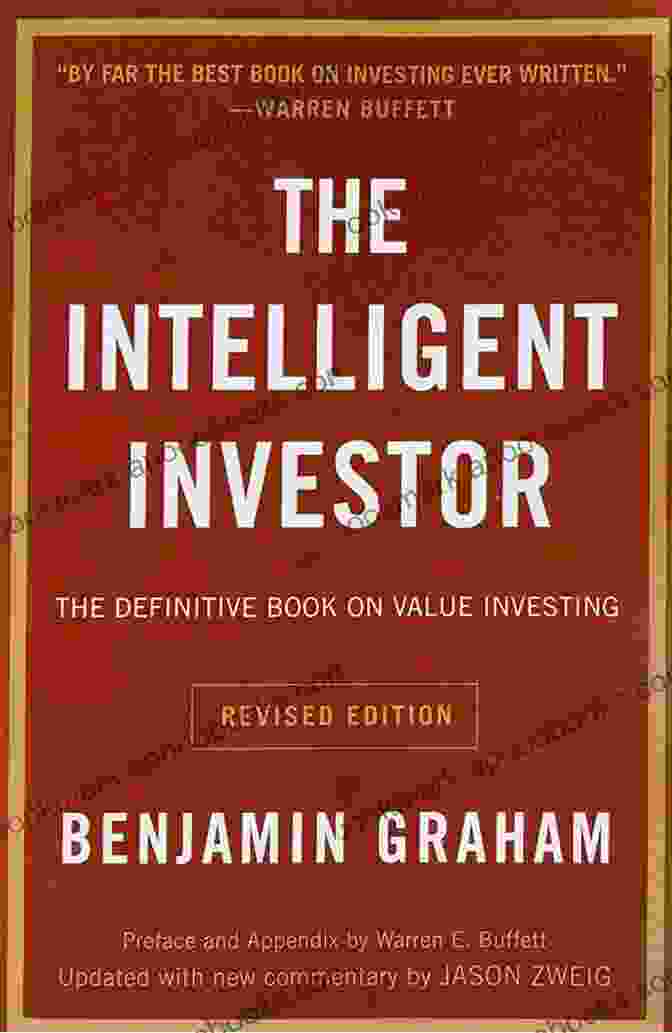

Unveiling the Blueprint for Investment Success: The Definitive on Value Investing by Benjamin Graham

: The Genesis of Value Investing

In the annals of investment history, Benjamin Graham stands as a towering figure, revered as the "Father of Value Investing." His seminal work, "The Definitive on Value Investing," first published in 1949, has become an indispensable guide for generations of investors seeking to navigate the complexities of the stock market. This article delves into the profound insights and timeless principles that reside within this investment masterpiece.

Chapter 1: The Principles of Value Investing

Graham establishes the cornerstone principle of value investing: acquiring stocks that trade below their intrinsic value, ensuring a margin of safety. He emphasizes the importance of thorough research and analysis to identify undervalued companies with strong fundamentals.

4.5 out of 5

| Language | : | English |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Lending | : | Enabled |

| File size | : | 331 KB |

| Print length | : | 28 pages |

| Screen Reader | : | Supported |

Chapter 2: The Margin of Safety

To mitigate risk, Graham advocates for a margin of safety when purchasing stocks. This buffer ensures that even if the company's performance falls short of expectations, the investor is still likely to achieve a positive return.

Chapter 3: The Formula Approach

Graham introduces a systematic approach to value investing, known as the "Formula Approach." This involves using specific financial ratios to screen for undervalued stocks. The ratios include book value, earnings per share, and dividend yield.

Chapter 4: The Value Line Approach

Recognizing the limitations of the Formula Approach, Graham presents the "Value Line Approach," which incorporates a broader range of factors in stock valuation. This approach considers industry trends, management quality, and long-term growth potential.

Chapter 5: Defensive Investing

In uncertain market conditions, Graham recommends a defensive investment strategy focused on preserving capital. This involves investing in high-quality companies with stable earnings and low debt.

Chapter 6: Enterprising Investing

For investors with a higher risk tolerance, Graham outlines an "enterprising" investment strategy aimed at achieving higher returns. This strategy involves investing in companies with above-average growth potential, but it also carries greater risk.

Chapter 7: Dividends and Interest

Graham emphasizes the importance of dividends and interest income in long-term investment success. He advocates for investing in companies with a consistent dividend record and attractive interest rates on bonds.

Chapter 8: Common Mistakes to Avoid

Graham cautions investors against common pitfalls that can erode their returns. These include following market trends, speculating on untested stocks, and failing to diversify their portfolios.

Chapter 9: The Psychology of Investing

Graham acknowledges the psychological challenges of investing and offers guidance on managing emotions and avoiding irrational investment decisions. He emphasizes the importance of patience and discipline.

Chapter 10: How to Follow the Value Approach

Graham provides practical tips for implementing the value investing approach. He outlines a step-by-step process for researching and selecting stocks, as well as managing a portfolio.

Legacy and Impact: The Enduring Influence of Benjamin Graham

"The Definitive on Value Investing" has profoundly influenced the investment philosophy of countless individuals, including Warren Buffett, the world's most successful investor. Graham's principles of value investing have stood the test of time, providing a solid foundation for investors seeking long-term financial success.

: The Indispensable Guide for Investors

"The Definitive on Value Investing" remains an essential resource for investors of all levels. Its timeless insights, practical strategies, and emphasis on financial literacy empower readers to navigate the complexities of the stock market and achieve their investment goals. Whether you are a seasoned investor or just starting your journey, this book offers an invaluable roadmap to financial success.

4.5 out of 5

| Language | : | English |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Lending | : | Enabled |

| File size | : | 331 KB |

| Print length | : | 28 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Nina Kedar

Nina Kedar Michael Jecks

Michael Jecks Nicholson Baker

Nicholson Baker Marinda Freeman

Marinda Freeman Duncan Mccargo

Duncan Mccargo Erwin C Hargrove

Erwin C Hargrove Katheryn Lane

Katheryn Lane Joanna Cazden

Joanna Cazden Edith Reynolds

Edith Reynolds Russel Tarr

Russel Tarr Rahul Varma

Rahul Varma James Kyung Jin Lee

James Kyung Jin Lee Paul Calore

Paul Calore Edith Hamilton

Edith Hamilton Jeff Dolven

Jeff Dolven Karl Marx

Karl Marx Scott Hollenbeck

Scott Hollenbeck James Calbraith

James Calbraith Woosen Ur

Woosen Ur Edith Marcombe Shiffert

Edith Marcombe Shiffert

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Felix CarterPoetry With Hint Of Lunacy: A Literary Journey into the Uncharted Territories...

Felix CarterPoetry With Hint Of Lunacy: A Literary Journey into the Uncharted Territories...

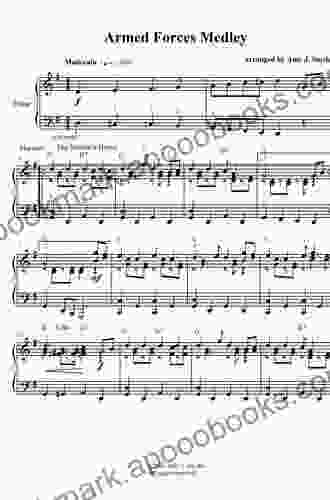

Brian WestMusic In The British Armed Forces During The Great War: Studies In The Social...

Brian WestMusic In The British Armed Forces During The Great War: Studies In The Social... George R.R. MartinFollow ·12.8k

George R.R. MartinFollow ·12.8k Junot DíazFollow ·3k

Junot DíazFollow ·3k Tony CarterFollow ·4.9k

Tony CarterFollow ·4.9k Jake CarterFollow ·6.6k

Jake CarterFollow ·6.6k Quentin PowellFollow ·16.8k

Quentin PowellFollow ·16.8k Wayne CarterFollow ·4.2k

Wayne CarterFollow ·4.2k Julian PowellFollow ·10.5k

Julian PowellFollow ·10.5k Samuel BeckettFollow ·8k

Samuel BeckettFollow ·8k

Eugene Powell

Eugene PowellFat Cat Stories: Level At Word Family - A Purrfect Start...

Introducing the 'At'...

William Powell

William PowellUnveiling the Treasures of Russian Poetry: The Cambridge...

Immerse yourself in the...

Roberto Bolaño

Roberto BolañoUnveiling the Treasures of Beowulf: A Guided Tour with...

: Delving into the...

Foster Hayes

Foster HayesTransport, Climate Change and the City: Tackling Urban...

Transport is a major...

Calvin Fisher

Calvin FisherHow To Make It In The Music Industry: The Ultimate Guide...

Are you an aspiring musician with...

Rick Nelson

Rick NelsonUnveiling the Enigmatic World of Gary Chester's "The New...

Step into a World...

4.5 out of 5

| Language | : | English |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Lending | : | Enabled |

| File size | : | 331 KB |

| Print length | : | 28 pages |

| Screen Reader | : | Supported |